Social security lump sum calculator

SSAct section 1171 1 Deemed lump. If the taxpayer does have taxable social security benefits select SSA Lump-Sum Payment Worksheet.

Valuing Social Security As A Retirement Income Asset

If you need to add a second lump-sum payment you can do so.

. Many people who rely on monthly social security disability payment as their sole source of income wont owe taxes. Click on the SS Benefits Alimony Misc. For more information or to do calculations concerning Social Security please visit the Social Security Calculator.

2 However reporting the lump sum as income for one tax. Lump-Sum Payments Begin Worksheet Each field and the information within are listed below. If your full retirement age benefit was 2000 per month then you could claim up to 12000 in a lump payment provided you had deferred your Social Security payments for at.

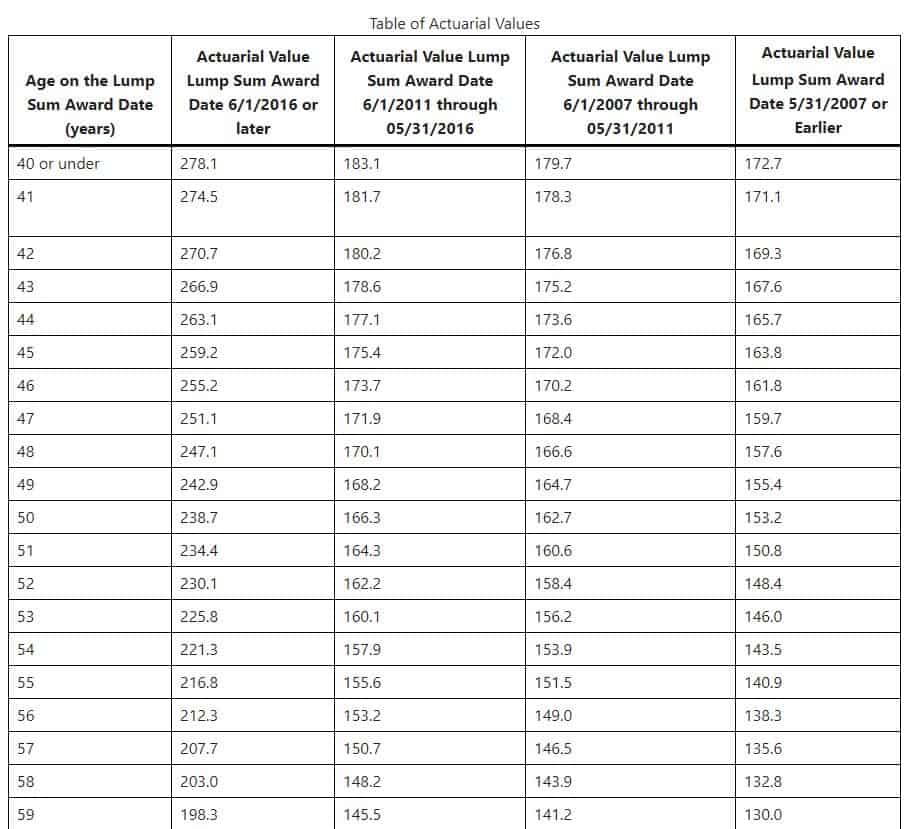

Enter the Social Security payment in Social security benefits SSA-1099 box 5. Each time a subsequent lump sum is paid the divisor applying at that later time is used to recalculate the preclusion period. The 10000 is then divided by twelve as it is only twelve months before she turns 62 which is retirement age which comes to about 833 a month.

What is a typical pension payout. Instead it will estimate. Social Security Benefits - Lump-Sum Payments TaxAct supports Worksheet 1 Figuring Your Taxable Benefits from IRS Publication 915 Social Security and Equivalent Railroad Retirement.

In 2020 you received 3000 in social security benefits and in 2021 you received 2700. Please note that the expected returns is just an estimation based on the figures. 180000 3 x 20 15 - 20000 60000 The taxable amount of your lump sum is 40000 100000 - 60000.

In March 2021 the SSA notified you that you should have received only 2500 in benefits in 2020. Then you subtract any taxable. The average amount is.

A 1500 per month your Social Security benefit is worth hundreds of thousands of dollars at a minimum and that doesnt factor in. The program will calculate the current year amount of taxable benefits and adjust the amount. For example when someone is granted disability benefits theyll receive a.

Under this method you refigure the taxable part of all your benefits including the lump-sum payment for the earlier year using that years income. On the left-side menu select Income. Select New and then select the year for which benefits were received during the.

A lump-sum payment is a one-time Social Security payment that you received for prior-year benefits. All information is required to correctly calculate the taxable income on your return. The Windfall Elimination Provision WEP rule impacts ones own retirement benefit and the Government Pension Offset GPO rule impacts spousal and survivor benefits.

The absolute maximum lump-sum payment that the Social Security Administration will make is six months worth of benefits. So if your full retirement age is 67 then youll qualify for the six. Based on the 80 rule you can expect to need approximately 96000 in annual income or 8000 per month when you retire.

The three calculators above are mainly designed for the Defined-Benefit. The online calculator will calculate the return generated ie 2895992 and the maturity amount ie. Benefit estimates depend on your date of birth and on your earnings history.

Youd need 529411 for it to last 30 years. If your severance pay is less than R500000 youll not pay any tax. For security the Quick Calculator does not access your earnings record.

If you go back to work during the year you reach FRA 1 in benefits will be. Because you are 11040 over the annual limit your Social Security benefits are reduced by 5520. This sum is subtracted from.

Lottery Payout Options Annuity Vs Lump Sum

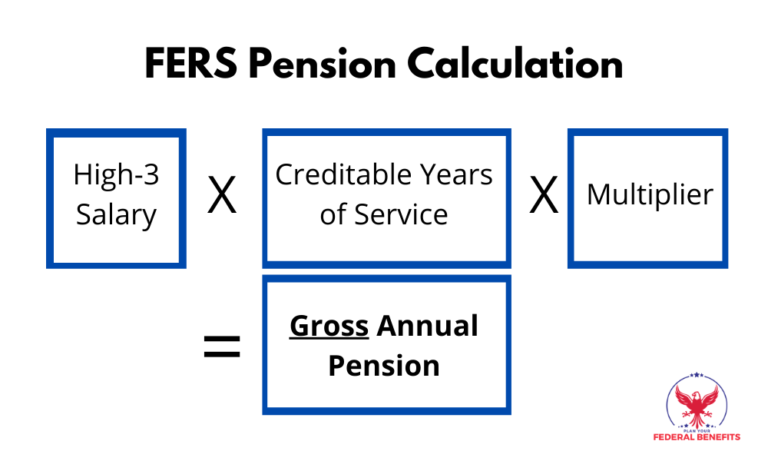

Can I Take My Fers Pension As A Lump Sum Government Deal Funding

Retire In Progress Defined Benefits Lump Sum Value

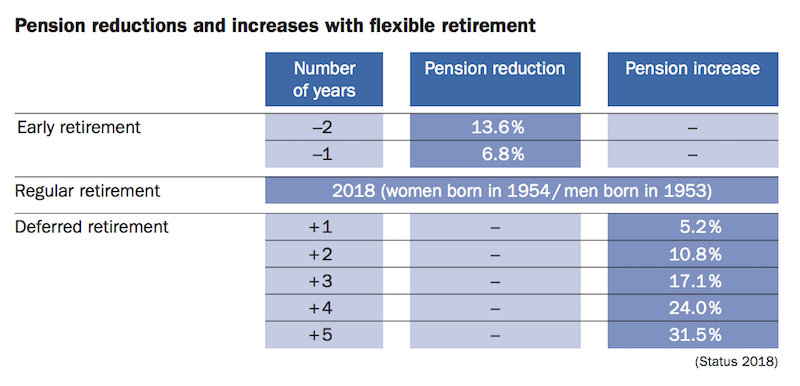

Strategies To Maximize Pension Vs Lump Sum Decisions

Lump Sum How To Complete A Monthly Invoice Video Youtube

1040 Lump Sum Social Security Distributions

Valuing Social Security As A Retirement Income Asset

Taking Social Security Benefits In A Lump Sum

Strategies To Maximize Pension Vs Lump Sum Decisions

How Much Is Ge Shortchanging Pensioners Taking Lump Sums Use Our Calculator Pensions Calculator Words Data Charts

Social Security And Lump Sum Pensions What Public Servants Should Know Social Security Intelligence

Is The Blended Retirement System Lump Sum Option Right For Me Usaa

Solved Earlier Year Lump Sum Social Security Benefit

Solved Earlier Year Lump Sum Social Security Benefit

Social Security The Hidden Risk Of A Lump Sum Payment Money

The Lump Sum Retroactive Social Security Payment Youtube

Learn How To Manage Your Pension How To Use Online Tools To Estimate It How To Calculate The Value Of A Lump Sum Finance Investing Pensions Annuity Calculator